Undercapitalization of Indian Debt Market

The Economic Survey 2024-25 highlighted that India’s debt market remains undercapitalised, and risky borrowers are unable to access it.

What is Debt Market?

- The Debt Market is part of the securities market where debt securities, also known as ‘fixed income securities’, of various types and features are issued and traded.

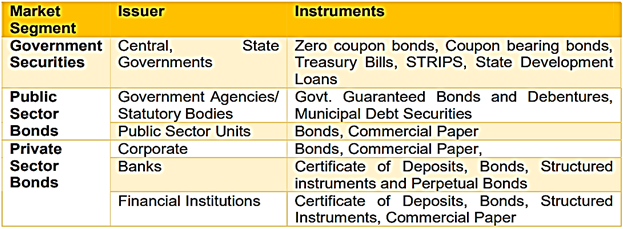

- Issuers in this market include central and state governments, municipal corporations, financial institutions, banks, public sector units, public limited companies, private companies, real estate investment trusts, infrastructure investment trusts etc.

Instruments Traded in Debt Market

Do You Want to Read More?

Subscribe Now

To get access to detailed content

Already a Member? Login here

Take Annual Subscription and get the following Advantage

The annual members of the Civil Services Chronicle can read the monthly content of the magazine as well as the Chronicle magazine archives.

Readers can study all the material since 2018 of the Civil Services Chronicle monthly issue in the form of Chronicle magazine archives.

Economy Watch

- 1 Financialisation of the Economy

- 2 National Critical Minerals Mission

- 3 Diamond Imprest Authorization Scheme

- 4 Team Initiative:Boosting Digital Commerce for MSMEs

- 5 Logistics Ease Across Different States (LEADS) 2024 Report

- 6 Extra-long Staple Cotton

- 7 Mutual Credit Guarantee Scheme for MSMEs

- 8 National Manufacturing Mission

- 9 Bharat Cleantech Manufacturing Platform

- 10 Five New Industrial Clusters from India join WEF Initiative