Regulatory Compliance by RBI

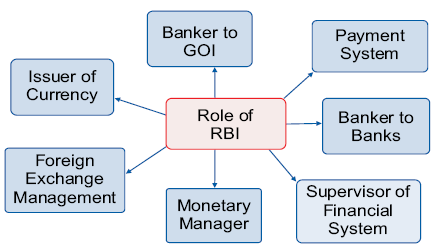

Functions of RBI

1. Monetary Policy Transmission:

The Reserve Bank of India asked banks to mandatorily link retail and SME loans to an external benchmark from October 1 2019, with a view to allowing faster transmission of rate cuts to consumers. The initiative by the RBI to mandate banks to reset interest rates under external benchmark at least once in three months from the earlier practice of resetting interest rates once in a year under marginal cost of lending rate (MCLR). It will greatly help in transmission of the RBI’s monetary policy.

Do You Want to Read More?

Subscribe Now

To get access to detailed content

Already a Member? Login here