Regulatory Compliance by RBI

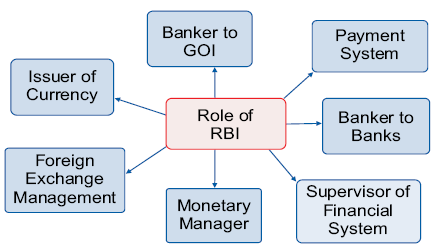

Functions of RBI

1. Monetary Policy Transmission:

The Reserve Bank of India asked banks to mandatorily link retail and SME loans to an external benchmark from October 1 2019, with a view to allowing faster transmission of rate cuts to consumers. The initiative by the RBI to mandate banks to reset interest rates under external benchmark at least once in three months from the earlier practice of resetting interest rates once in a year under marginal cost of lending rate (MCLR). It will greatly help in transmission of the RBI’s monetary policy.

Do You Want to Read More?

Subscribe Now

Take Annual Subscription and get the following Advantage

The annual members of the Civil Services Chronicle can read the monthly content of the magazine as well as the Chronicle magazine archives.

Readers can study all the material before the last six months of the Civil Services Chronicle monthly issue in the form of Chronicle magazine archives.

Related Content

Prelims Special

- 1 Global Gender Gap Index 2020

- 2 World Health Statistics 2019

- 3 Human Capital Index

- 4 Human Development Index

- 5 Multidimensional Poverty Index 2018

- 6 Tourism Sector

- 7 Overview of Information Technology Sector

- 8 Overview of Real Estate and Housing Sector

- 9 Manufacturing Sectors

- 10 Innovations

- 11 Initiatives to Reform MSME’s

- 12 Logistics Reforms

- 13 Resolving Insolvency

- 14 Initiatives taken by DPIIT for the Reform Process

- 15 Implementation of Business Reforms

- 16 Ease of Doing Business

- 17 Allied Sectors- Dairy, Fisheries and Livestock

- 18 Potential in Eastern States

- 19 Crop Insurance Schemes

- 20 Land Leasing Laws

- 21 Food Processing

- 22 Agri Marketing and Trade

- 23 Initiatives to Receive Remunerative Prices

- 24 Science and Technology in Agriculture

- 25 Fertilizers

- 26 Farming and Food Security

- 27 Initiatives to Raise Agriculture Productivity

- 28 Overview of agriculture and allied sectors

- 29 Financial Market

- 30 Direct Tax Code

- 31 Status Paper on Government Debt

- 32 Finance Minister Announces New Fiscal Reforms

- 33 Capital Gains Tax

- 34 Direct Tax Collection in the Negative Zone

- 35 Goods and ServicesTax

- 36 Rising Fiscal Deficit

- 37 Pradhan Mantri Laghu VyapariYojana

- 38 PM Shram Yogi Mandhan Yojana

- 39 Employment Scenario

- 40 National Minimum Wage

- 41 First Advance Estimates of National Income,2019-20

- 42 Slowdown in Economic Growth: India’s Sep-quarter GDP growth slips to 4.5%, the lowest in over six

- 43 Indian Statistical System

- 44 New GDPMethodology

- 45 External Sector

- 46 Crisis in NBFC’s

- 47 Digital Economy

- 48 Differential Banks

- 49 Measures to Reduce NPA’s

- 50 Banks Consolidation

- 51 Recent RBI Committees/ Reports

- 52 Prelims Mock Test 2020

- 53 Poverty