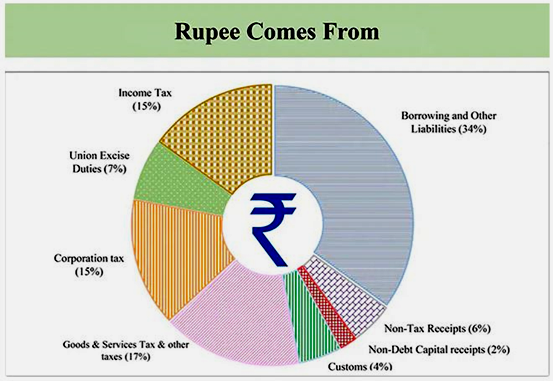

Sources of Government Revenue

Government revenue, also known as public revenue or government income, refers to the total amount of money collected by a government from various sources to finance its operations, programs, and services.

Revenue Sources

- Income Tax: Income tax is a direct tax imposed by the government on the income earned by individuals, businesses, and other entities within its jurisdiction.

- It is calculated based on the total income or profits earned and is typically paid annually. Income tax is designed to fund government operations, social programs, and public services.

- Union Excise Duties: ....

Do You Want to Read More?

Subscribe Now

Take Annual Subscription and get the following Advantage

The annual members of the Civil Services Chronicle can read the monthly content of the magazine as well as the Chronicle magazine archives.

Readers can study all the material before the last six months of the Civil Services Chronicle monthly issue in the form of Chronicle magazine archives.

Related Content

Indian Economy

- 1 Inflation: Measurement and Control Measures

- 2 Banking Regulation – Insolvency and NPAs

- 3 Marketing of Agricultural Produce: Mechanisms in Place

- 4 Indigenous Seeds: Infrastructure & Management

- 5 Agro-based Industries in India

- 6 Road & Water Transport Network & Infrastructure

- 7 Satellite Towns: Infrastructure Development Programmes

- 8 Types of Tax in India

- 9 Socio-economic Welfare: Important Indicators

- 10 Measurement of Economic Growth: Key Indicators