Surety Bonds

Recently, the Ministry for Road Transport & Highways (MoRTH) has asked insurance regulator IRDAI to develop a model product on Surety Bonds in consultation with general insurers.

About Surety Bonds

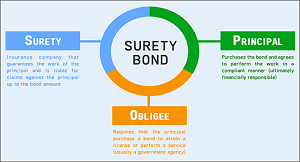

- A surety bond is a promise to be liable for the debt, default, or failure of another.

- It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

|

IRDAI (Surety Insurance Contracts) Guidelines, 2022

|

Do You Want to Read More?

Subscribe Now

Take Annual Subscription and get the following Advantage

The annual members of the Civil Services Chronicle can read the monthly content of the magazine as well as the Chronicle magazine archives.

Readers can study all the material before the last six months of the Civil Services Chronicle monthly issue in the form of Chronicle magazine archives.

Related Content

- 1 Bharat Tex 2025

- 2 RuTAGe Smart Village Center

- 3 New Maritime Initiatives to Enhance India’s Global Trade

- 4 Dinesh Khara Committee

- 5 SEBI Proposes Fast-Track Follow-On Offers for REITs & InvITs

- 6 Tobin Tax

- 7 Bond Central

- 8 Grameen Credit Score: A New Chapter in Rural Finance

- 9 Expansion of e-NAM Platform

- 10 RBI Survey on Farmer’s Share of Consumer Prices